PRODUCT

Smarter Biometrics, Stronger Digital Identity.

VIEW ALL

product finder

solution

case study

support

Company

Identifying the World. Easily, Securely.

years of solid experience

20+

.jpg)

400+

customised projects

EN

.avif)

In an era where technology continually redefines convenience and security, the banking sector stands at the forefront of this transformation. Biometric automated teller machines (biometric ATMs), a groundbreaking innovation, are reshaping the landscape of financial transactions.

The future of banking is literally at our fingertips. Consider an ATM that recognizes you based on your face, fingerprints, the distinct pattern of your iris or voice, or the intricate map of veins in your finger. Hello and welcome to the world of biometric ATMs. As we embark on this journey, let us explore the transformative potential of biometrics in reshaping the banking experience for both customers and financial institutions through biometric ATMs.

A Biometric ATM is an advanced automated teller machine that utilizes biometric authentication methods to authenticate users based on one or more physical or behavioral characteristics, ensuring a secure, personalized, and efficient banking experience. Unlike traditional ATMs, which rely on a card and PIN for user authentication, a biometric ATM leverages biometric technologies such as fingerprint recognition, facial recognition, iris scanning, and voice recognition to authenticate a customer's identity, allowing them to make a range of ATM services such as cash withdrawals, deposits, balance inquiries, fund transfers, bill payments, and even more intricate financial services like loan applications and account management.

This innovative approach not only enhances the security of financial transactions by employing biometric measures that are difficult to forge or steal but also optimizes user convenience by facilitating cardless and PIN-less transactions. By intertwining technology and security, biometric ATMs stand as a testament to the evolution of secure banking, offering a robust platform where the unique biological attributes of an individual become the sole identifier, thereby mitigating risks associated with identity theft and ATM fraud.

Biometric ATMs seamlessly integrate biometric technologies to offer a secure and personalized user experience. Here's how they employ various biometric measures and types:

Through advanced fingerprint scanners, these ATMs integrate a fingerprint sensor module to analyze the unique patterns of a user's fingerprint. This method is not only quick but also highly secure, given the distinctiveness of each individual's fingerprint.

By harnessing cutting-edge facial recognition technology, Biometric ATMs can swiftly identify customers based on distinct facial features. This offers a hands-free authentication process, enhancing user convenience.

Utilizing specialized cameras, these ATMs scan the unique patterns found in the colored part of an eye. Iris patterns are complex and unique to each individual, making this method one of the most secure forms of biometric authentication.

Biometric ATMs can identify users through their vocal characteristics and patterns, captured via integrated microphones. This method not only ensures security but also aids users with physical disabilities, offering an alternative mode of authentication.

By scanning the unique vein patterns in a finger using infrared light, these ATMs offer an added layer of security. Finger vein print biometrics, being internal, are extremely difficult for fraudsters to replicate, ensuring a higher level of protection against potential threats.

Each of these biometric measures, combined with the respective devices, ensures that biometric ATMs provide an authentication process that is not only secure but also user-friendly, efficient, and inclusive.

Biometric ATMs stand out as a pinnacle of secure and user-friendly financial transactions. Your biological attributes serve as your only customer identifier, ensuring that you, and only you, can access your account and perform transactions. This eliminates the need to remember PINs or carry cards, providing a seamless and secure transaction experience.

Biometric ATMs are not merely cash dispensing machines; they are sophisticated devices that integrate advanced technologies to ensure secure financial transactions. Here’s how they intertwine technology and security:

Some biometric ATMs may use additional security credentials, combining biometric data with a PIN or a mobile device, to add an extra layer of security.

Designed with users in mind, biometric ATMs often feature intuitive interfaces, ensuring that customers can navigate and complete transactions with ease.

Biometric ATMs are not confined to a particular region or country. From the bustling cities in the Middle East to the financial hubs in the West, these ATMs are being adopted globally, signifying a universal shift towards secure and technologically advanced banking solutions.

Biometric ATMs also pave the way for inclusivity in financial transactions. By eliminating the need for literacy and numeracy skills to conduct transactions, they provide an accessible platform for all users, regardless of their educational background.

In essence, a Biometric ATM is not merely a machine; it's a sophisticated, secure, and user-centric portal that redefines how we perceive and interact with financial institutions. It intertwines advanced biometric solutions with the conventional functionalities of ATMs, ensuring that your transactions are not only secure but also convenient and accessible. In the following sections, we'll go deeper into the multifaceted benefits and applications of biometric ATMs in today's banking ecosystem.

Biometric ATMs lie in their ability to seamlessly integrate advanced technology with user-centric functionalities. But how exactly does this sophisticated machine transform your unique biometric traits into a secure transaction medium? Let's check out the process.

Before you can enjoy the benefits of a Biometric ATM, there's a crucial initial step: enrollment.

When you approach a Biometric ATM for a transaction:

When you engage with a biometric ATM for transactional purposes:

Ensuring a secure conclusion after each interaction:

In essence, biometric ATMs revolutionize the banking experience by combining the familiarity of traditional ATMs with the advanced security and convenience of biometric solutions. By prioritizing both user experience and security, they stand as a testament to the future of secure financial transactions in the banking industry.

The integration of biometric solutions into ATMs has ushered in a new era of banking, where convenience meets unparalleled security. Let's check out the multi-faced benefits that biometric ATMs offer to both customers and financial institutions.

Biometric ATMs provide an added layer of protection against identity theft and ATM fraud. With biometric measures like fingerprint and iris recognition, it becomes exceedingly challenging for unauthorized individuals to access your account.

Gone are the days of remembering PINs or ensuring you have your ATM card. With biometric authentication, your unique biological attributes are all you need to conduct transactions, making the process faster and more user-friendly.

Biometric ATMs cater to a broader audience, including those who might find traditional ATMs challenging, such as the visually impaired or the elderly. Voice recognition and face recognition features ensure that everyone can access banking services with ease.

By eliminating the need for physical ATM cards and the associated costs of production, distribution, and replacement, financial institutions can realize significant cost savings. Additionally, the enhanced security features of biometric ATMs lead to a reduction in costs associated with fraud prevention, investigations, and reimbursements.

By leveraging biometric measures, financial institutions can significantly reduce instances of fraud, enhancing the overall security of financial transactions.

Offering state-of-the-art biometric ATMs can significantly enhance a bank's reputation, fostering trust and loyalty among customers who value both security and convenience.

Adopting biometric ATMs positions financial institutions at the forefront of technological advancements, ensuring they are well-equipped to meet the evolving demands of modern banking.

In conclusion, the advent of Biometric ATMs is not just a technological advancement; it's a transformative shift in the banking landscape. By offering a plethora of benefits that cater to both individual users and financial institutions, these ATMs signify a future where banking is efficient, secure, and tailored to the unique needs of every individual. As we continue our exploration, it becomes evident that the fusion of biometrics and ATMs is not just a trend but a sustainable and beneficial evolution in the world of financial transactions.

The integration of biometric technology into ATMs has seen a global uptake, with various countries pioneering its implementation to enhance security and user experience. Here are five real-world use cases that highlight the growing adoption of Biometric ATMs:

Seven Bank: This bank in Japan has been at the forefront of biometric banking, having rolled out a trial of Facial Recognition at its ATMs. By using facial recognition as an additional security layer, Seven Bank ensures that the card's owner is the one accessing the ATM, enhancing customer convenience and security.

First National Bank (FNB): FNB in South Africa has introduced fingerprint-based biometric ATMs to provide a more secure and convenient banking experience. These ATMs use fingerprint recognition technology to authenticate users, ensuring a seamless transaction process while minimizing the risk of fraud.

Qatar National Bank (QNB): QNB has incorporated iris recognition technology in its ATMs, offering a higher level of security to its customers. This advanced biometric feature ensures that only the authorized user can access their account, providing an added layer of protection against potential threats.

Banco Bradesco: One of the largest banks in Brazil, Banco Bradesco, has integrated palm vein biometric technology into its ATMs. This technology scans the vein pattern of a user's palm, offering a unique and secure method for authentication.

CaixaBank: CaixaBank has initiated the deployment of ATMs equipped with facial recognition technology across Spain. These ATMs are capable of validating up to 16,000 points on a user's face, ensuring a highly secure identification process. This innovative approach allows customers to withdraw money without manually entering a PIN, emphasizing both security and convenience.

These real-world implementations underscore the versatility and global acceptance of biometric ATMs. As the banking sector continues to innovate, biometric ATMs stand out as a beacon of secure, convenient, and user-centric banking solutions.

The banking sector, a cornerstone of our global economy, is in the midst of a transformative era. As we've journeyed through various global implementations, it's evident that biometric ATMs are not just a fleeting trend but a robust response to the growing demands for security and convenience in financial transactions. This evolution is not just about technology; it's about trust. It's about ensuring that every individual, whether withdrawing cash in Tokyo or checking an account balance in Johannesburg, can do so with the confidence that their financial data and assets are protected. It's about recognizing the unique identity of each customer and validating it with impeccable accuracy.

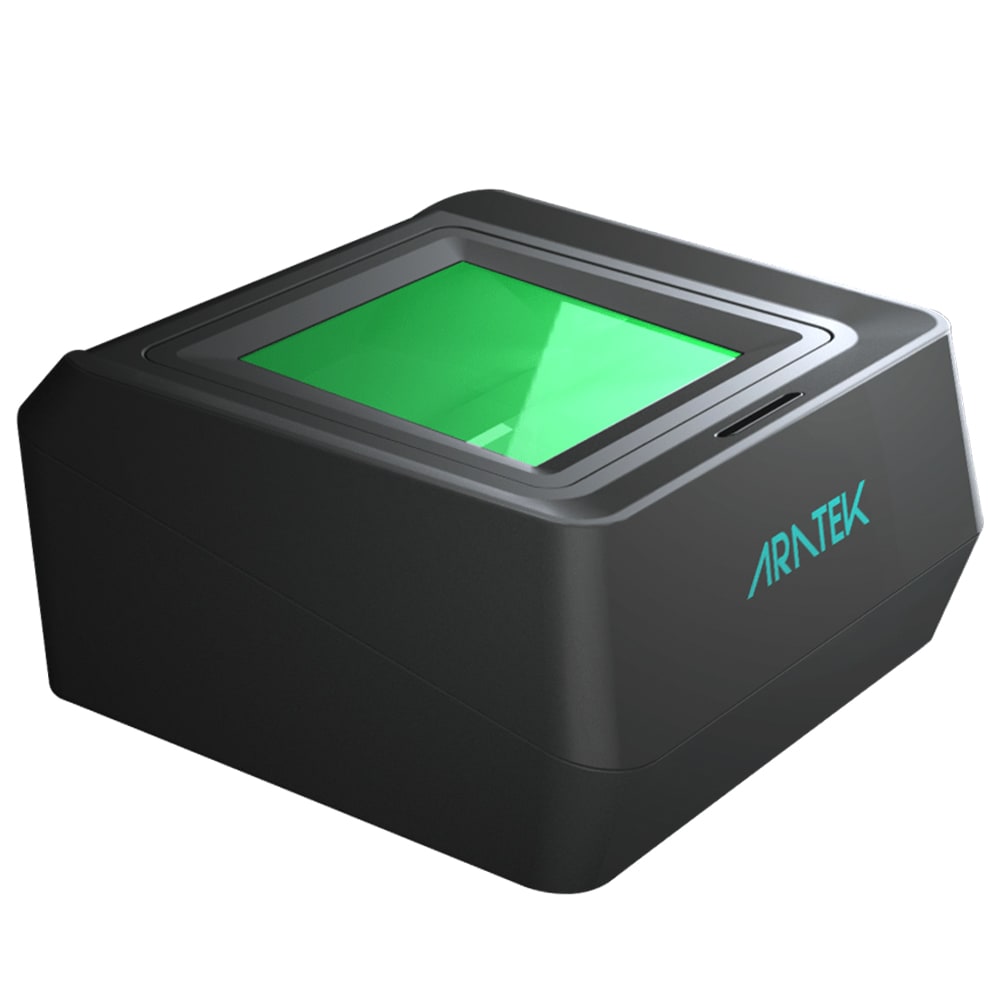

At Aratek Biometrics, we're proud to be at the forefront of this transformation. Our state-of-the-art embedded fingerprint module sensors are designed to seamlessly integrate with ATMs, empowering financial institutions to offer swift and secure fingerprint-based authentication to their customers.

As the demand for secure and user-friendly banking solutions grows, we're committed to delivering cutting-edge biometric solutions that meet the needs of both financial institutions and their customers. If you're a financial institution looking to elevate your ATM services or a business keen on integrating biometric solutions, Aratek Biometrics is here to help you every step of the way. Connect with us today and let's shape the future of secure banking together.

.avif)

Use our product finder to pinpoint the ideal product for your needs.