PRODUCT

Smarter Biometrics, Stronger Digital Identity.

VIEW ALL

product finder

solution

case study

support

Company

Identifying the World. Easily, Securely.

years of solid experience

20+

.jpg)

400+

customised projects

EN

.avif)

Biometric payment technology is quickly becoming the new way to pay.

A Visa survey conducted in May 2022 revealed that 86% of consumers were enthused to use biometrics for authentication when making payments. Furthermore, 70% expressed it was simpler to use than passwords or PINs, and 46% thought they provided enhanced security compared to the other options.

But what exactly is biometric payment? Why should you use biometric payments instead of traditional methods? Well, biometric payment offers several advantages over traditional methods. It's faster, more secure, and utterly convenient. Let’s take a closer look at why biometric payment technology is the future of payments.

Biometric payment is an innovative digital transaction method that enables users to complete a purchase through the authentication of their physical characteristics, such as fingerprints, facial images, or iris scans.

This form of payment eliminates the need for users to submit their financial information every time they make a purchase. Instead, biometric payment uses unique physical identifiers, such as fingerprints or facial recognition data, to confirm identity. The technology then securely processes the authentication and transaction in one seamless process.

Biometric payment technology is becoming increasingly popular as it eliminates the need for users to remember complicated usernames and passwords. Plus, it provides a more secure way to make payments as biometric data is unique to each individual.

Biometric payment technology is revolutionizing the way we make purchases, incorporating efficient methods of biometric authentication that ensure ease and security. With fingerprint recognition, facial recognition, and iris scanning all rapidly integrated into the process, users can rest assured their payments are secure. Popular biometric authentication methods utilized by payment solutions include:

Fingerprint recognition is used to identify individuals based on their fingerprints. The technology uses specialized sensors to capture an image of the user’s fingerprint, which is then compared against an existing database of known fingerprints.

This biometric authentication method uses facial recognition algorithms to compare two sets of facial images and confirm identity. It works by comparing certain features of the face, such as the eyes and nose, to determine if the two images match.

Iris recognition is a method used to identify individuals based on the unique patterns in their iris. It works by capturing an image of the user’s eye with infrared light and then comparing it against a database of known iris patterns.

When used in combination with other security measures, such as encryption, biometric payment technology can be an invaluable tool in protecting users from fraud and theft. Plus, with the increasing prevalence of online transactions, this technology is becoming increasingly important for keeping users’ data safe and secure.

Harnessing the power of advanced algorithms and sophisticated hardware, biometric payment technology is making its way into the mainstream. By utilizing scanners such as fingerprint readers or facial recognition cameras, users can securely process transactions with their data serving to authenticate identity through an authentication algorithm. Below we will uncover all the key components behind biometric payment technology:

Biometric payment relies on sophisticated algorithms to process data and confirm the identity of users. These algorithms use pattern recognition to analyze features such as fingerprints or facial recognition data.

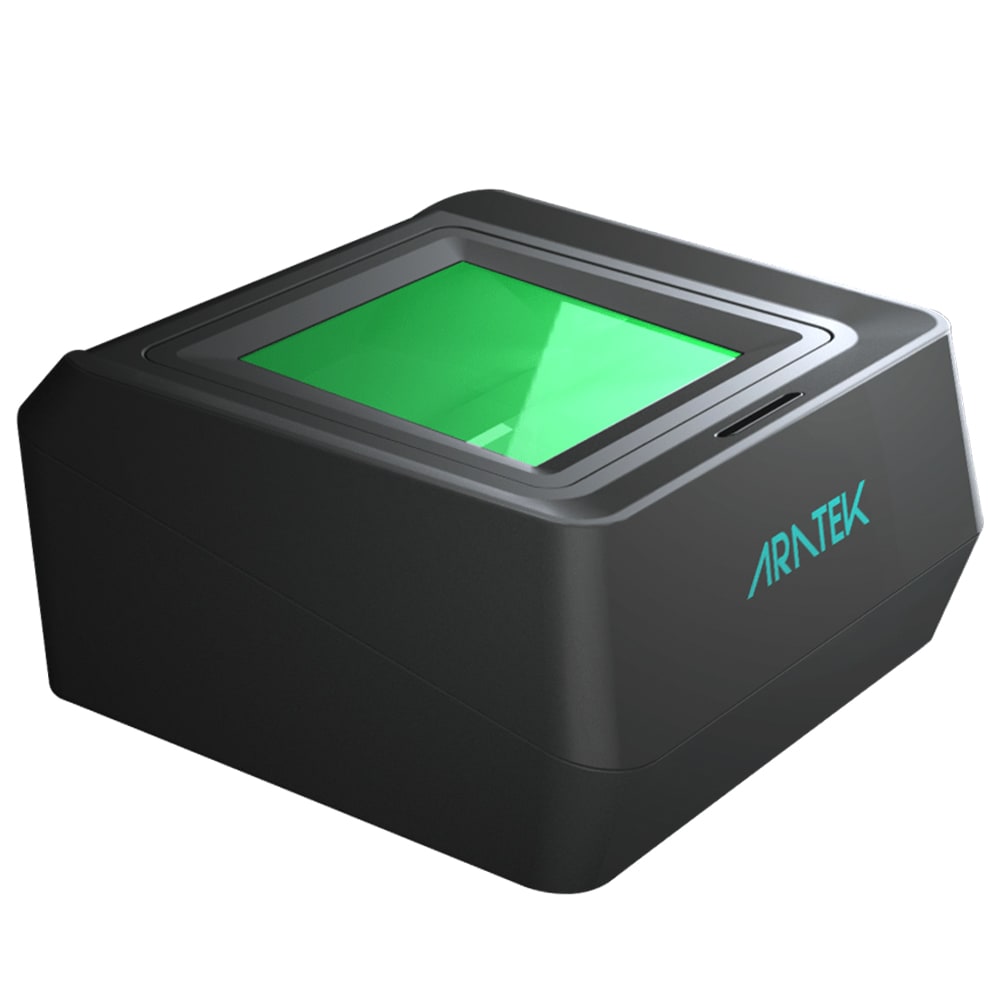

Biometric payment makes use of biometric POS terminals or biometric scanners, such as fingerprint scanners, iris scanners, or face recognition cameras, to capture a user's biometric data. This data is then sent to the authentication algorithm for verification and processing.

The mobile phone is rapidly evolving into a go-to device for biometric payment technology, with many companies introducing fingerprint sensors or facial recognition cameras to their phones. Coupled with apps like Apple Pay and Google Pay, users are now able to make secure transactions from the comfort of their smartphones - no more standing in line at stores or carefully entering their credit card numbers online!

As biometric payment cards have become a trend in recent years, VISA and Mastercard (the Mastercard Biometric Card) have both implemented their own versions of the technology. In addition, numerous financial institutions such as NatWest and Societe Generale are adding this secure alternative for customers by introducing biometric payment card options. Utilizing chip-embedded fingerprint sensors, these biometric cards guarantee maximum safety while processing payments quickly and efficiently.

Once the identity has been confirmed, the transaction is securely processed on secure servers. These servers use encryption and other security protocols to protect users' data and ensure that transactions remain private.

Finally, applications such as mobile digital wallets and payment apps provide biometric authentication for users. These are the most user-friendly methods of biometric payment and make it easy to complete transactions quickly and securely.

By combining the above technologies, biometric payment is able to provide a safe, secure, and convenient way for users to make digital payments. Here is the breakdown of the process when using biometrics in payments:

Before payment is processed, biometric authentication must take place to verify the user's identity. This typically involves scanning their fingerprint, face, or iris to confirm their identity.

Once the biometric data has been verified, the payment is then processed. This process involves verifying the user's payment credentials and authenticating the transaction with the relevant payment processor.

The payment is then authorized by the payment processor and the transaction is completed.

Finally, users will receive a notification to confirm that the transaction has been successful.

By combining biometric technology with processing and authorization, biometric payments are able to provide a secure and convenient way for users to make digital payments. Now that you know what technologies make biometric payment possible, let’s explore the potential security benefits it offers.

Biometric payments have revolutionized the way we make digital transactions, allowing us to complete them securely and conveniently. With biometric solutions and encryption, these payments provide an extra layer of security that helps to protect users' data. In addition, biometric payments have a range of other advantages and benefits, ranging from improved user experience to reduced fraud. From faster checkout times and greater convenience to enhanced security protocols and better customer service, here are 10 benefits of using biometric payments.

Biometric authentication is more rapid and reliable than conventional methods, enabling users to fulfill purchases instantly and securely, be it online or at the payment terminal.

Biometric payments are more secure than traditional methods as they use sophisticated algorithms to authenticate users and encrypt their data. This provides an extra layer of protection for users' digital payments.

By using biometric authentication, businesses can reduce fraud as it is virtually impossible to replicate a user's identity data.

With biometric payments, users can easily and securely complete transactions without having to recall clunky passwords or PINs; in fact, they can even use their own unique biological data such as facial recognition or fingerprints. By combining contactless payments into the mix, these transactions are made faster and more convenient than ever before.

Biometric authentication also helps to protect users' privacy as their identity data is securely stored on secure servers rather than in the hands of third parties.

As biometric authentication is faster and more accurate, it can help to reduce checkout times which will result in a better customer experience.

Biometric authentication reduces the amount of paperwork and manual processes associated with traditional payment methods which can help to reduce administrative costs.

As biometric authentication is more secure, it can help to protect customers' data which can result in improved customer service and satisfaction levels.

As biometric authentication is more secure, it can help to reduce transaction costs as fewer fraudulent transactions need to be processed.

Finally, biometric payments are becoming increasingly accessible for businesses and consumers alike. With a range of solutions available, it is now easier than ever for users to make secure digital payments. This will also improve the financial inclusion of those who are traditionally excluded from the banking system.

As you can see, biometric payments offer a wide range of potential benefits for businesses and consumers alike. From improved security to reduced fraud, there are numerous advantages to using this type of technology. In addition, it is important to note that biometric payments also come with their own set of potential drawbacks, which users should be aware of before using them.

While biometric payments offer a range of advantages, there are some potential drawbacks that users should be aware of before using them. As with any new technology, there is a risk of privacy concerns as users' biometric data is stored on secure servers. Also, depending on the type of biometric authentication used, there is a risk of inaccurate readings which could result in delays or inaccuracies when completing transactions. There may be certain drawbacks associated with biometric payments including:

Biometric authentication can be expensive to set up, which may put off some businesses from implementing the technology.

Privacy is of the utmost concern when it comes to biometric data, as this type of information tends to be stored centrally and can quickly be shared with outside organizations or even used for malicious intent.

Biometric authentication may not always be accurate or consistent, potentially leading to inaccurate readings and declined payment applications. For example, if a fingerprint is used as the method of identification but is smudged or damaged in any way, this could result in an inaccurate sensor reading if the quality of the fingerprint sensor isn't sufficient to detect these fingerprints.

Biometric payment systems can also present issues for certain groups, as it may be difficult for those with disabilities to use the technology. For example, those with vision impairments or limited mobility may struggle to complete transactions using biometric technologies.

Given the range of potential benefits and drawbacks, biometric payments can be beneficial in certain scenarios, such as:

Biometric payment technology is perfect for online shopping as it allows for secure and user-friendly transactions. Combined with mobile payments, this could make online shopping even more convenient and secure.

Banks are at the forefront of utilizing biometric payment technology to both protect their customers' data and curtail fraudulent activity. Some of the tools and technology they use are the biometric credit card, biometric bank card, fingerprint scanning, facial recognition, etc. all of which are made to make banking transactions safer and faster.

Biometric payments revolutionize the retail industry, speeding up checkout lines and facilitating a superior customer experience. For example, customers can securely pay through EMV terminals rapidly without needing to wait in long lines or fumble with cards that may slip away. Biometrics are proven to make for an ideal shopping environment where shoppers complete transactions quickly and securely.

Biometric payment technology is still in its developing stages and has the potential to revolutionize the payments landscape. There will be more and more applications of this technology in the coming years as people become more comfortable with using biometrics. It will be exciting to witness how far it takes us!

So, have you used biometric payment in any of the above scenarios already? If not, then it’s time to start exploring this exciting new technology and all the opportunities it can offer.

Biometric payments are a relatively new technology that offers many potential benefits, such as improved security, convenience, and accuracy. However, it is important to note the various drawbacks associated with this type of payment system before implementing it in your business or other areas.

The use cases for biometric payments range from online shopping to healthcare applications, but whatever the use case, it is essential to ensure that data security measures are in place to protect users' sensitive information. Ultimately, biometric payments offer a number of benefits and should be considered as an option for businesses or services looking to streamline processes and reduce fraud risk. The bottom line? Biometric payments certainly have the potential to revolutionize and simplify our lives, but it pays to be aware of the risks involved.

.avif)

Use our product finder to pinpoint the ideal product for your needs.