PRODUCT

Smarter Biometrics, Stronger Digital Identity.

VIEW ALL

product finder

solution

case study

support

Company

Identifying the World. Easily, Securely.

years of solid experience

20+

.jpg)

400+

customised projects

EN

.avif)

Ever tried to open a bank account and found yourself lost in a sea of paperwork? eKYC might just be the lighthouse you need. Welcome to the age of digital verification where customer onboarding is as simple as a click, swipe, or face scan.

eKYC, short for 'electronic Know Your Customer,' is that smart lad making rounds in the financial sector, the telecom industry, and other sectors who require customer verification. It's a digital solution for verifying a customer's identity swiftly, securely, and let's not forget, eco-friendlier. In this article, we'll embark on a journey to understand the roots of traditional KYC, the evolution into eKYC, and the transformative role of biometrics in this context. We'll highlight the importance of eKYC in today's businesses, such as financial institutions, and show you why adopting these digital processes can take your customer relationships and risk assessment capabilities to new heights.

eKYC, or 'Electronic Know Your Customer', is a digital procedure used for identity verification that allows businesses, primarily financial institutions, to conduct customer due diligence. As the digital counterpart to traditional KYC processes, eKYC is designed to streamline customer onboarding, minimize fraud risk, and enhance regulatory compliance.

The eKYC process brings not just simplicity and efficiency, but also a sustainable approach to customer identification. By replacing physical documents and face-to-face meetings with digital alternatives, it reduces carbon footprints while also speeding up the identification process. Here's how it works:

In a nutshell, eKYC signifies the adoption of digital processes to ensure customer verification, thus enhancing the overall efficiency, security, and customer experience in business transactions.

To understand the impact of eKYC, we must first examine its foundation: the traditional KYC process. Tracing its roots and significance in today’s digital landscape provides a necessary context for appreciating the shift towards eKYC. This exploration not only reflects on the origins and development of KYC practices but also sets the stage for comparing these traditional methods with the advanced approaches of eKYC.

Know Your Customer' (KYC) principles have long been the cornerstone of financial operations, aimed at preventing identity theft, financial fraud, and money laundering. Traditionally, this process has been manual and paper-intensive, involving physical documentation and in-person verification to establish the identity of clients. Let's examine how these foundational practices compare with the streamlined, technology-driven approach of eKYC.

Traditional KYC relies on customers manually filling out paper forms with details like name, date of birth, address, and occupation, and submitting physical copies of identification documents (e.g., passport, driver's license). eKYC, in contrast, digitalizes this step, enabling online data submission and document upload for a faster and more user-friendly process.

In the traditional framework, institutions manually cross-verify provided information against physical legal documents to authenticate a customer's identity, a process prone to delays. eKYC introduces automated technologies like OCR and biometric verification to expedite identity confirmation, reducing time and error.

Traditional KYC methods assess the risk of unlawful activities like money laundering through manual review of a customer's financial history and other factors. eKYC revolutionizes this by employing algorithms and data analytics for quicker, more precise risk assessment, often in real-time.

The traditional approach involves ongoing, manual monitoring of customer transactions to spot suspicious activities, requiring significant manpower and resources. eKYC leverages continuous, automated monitoring systems that use analytics to detect anomalies efficiently, enhancing security and compliance without constant manual intervention.

While the traditional KYC framework has been instrumental in safeguarding financial transactions, it is not without its drawbacks. The necessity for physical documents and manual verification makes the process not only time-consuming but also resource-intensive. These challenges underscore the need for a more efficient method, leading to the development and adoption of eKYC solutions that promise quicker turnaround times and reduced environmental impact.

eKYC is not a departure from the principles of the traditional KYC process; rather, it is an enhancement. eKYC processes respect the foundational objectives of KYC, which include customer identification, fraud prevention, and adherence to legal procedures.

eKYC leverages technology to streamline and accelerate the process of customer due diligence, making it:

Understanding the contrast and evolution from traditional KYC to eKYC can help us appreciate the innovative steps taken to optimize customer verification while retaining its effectiveness and trustworthiness. Up next, we'll delve into how biometrics is playing a role in taking eKYC to new heights.

In the world of digital identity and customer verification, biometrics is emerging as the new frontier. This advanced technology adds an extra layer of security to the eKYC process and is rapidly becoming a game-changer in the industry. But what exactly is biometrics, and how are they influencing eKYC? Let's take a look at the details.

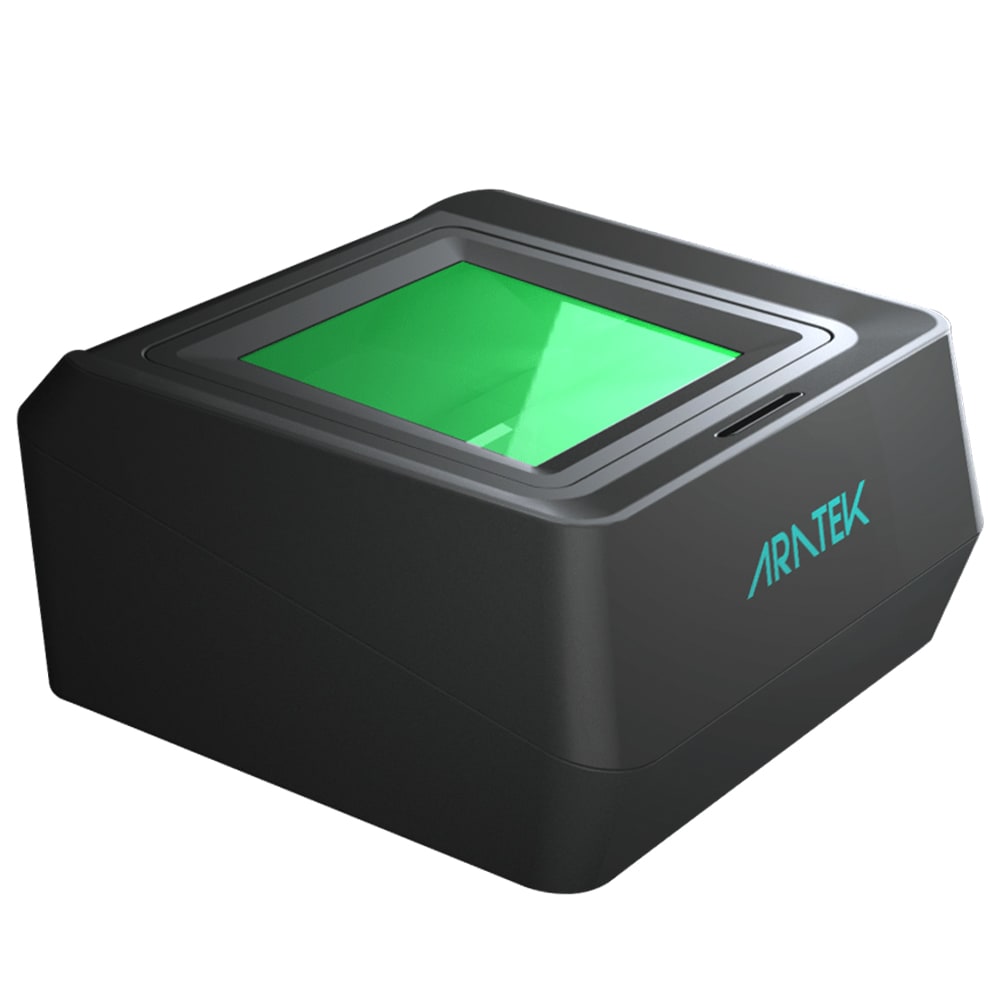

In its simplest form, biometrics is the measurement and analysis of unique physical or behavioral characteristics. These may include fingerprints, facial features, iris patterns, or even the unique rhythm of an individual's typing. In the context of eKYC, biometrics usually refers to facial recognition, fingerprint recognition, and sometimes even iris recognition.

When incorporated into the eKYC process, biometrics adds an additional layer of security and convenience. Here's how it's being utilized:

Biometrics can significantly elevate the verification process in eKYC, and here's why:

In the context of eKYC, biometric technology is not a replacement for traditional identity verification methods, but rather a powerful supplement that offers increased accuracy and security. By combining biometric verification with other identity checks, organizations can create a highly robust eKYC process that significantly reduces the likelihood of fraudulent activities.

Biometric mobile terminals are playing a pivotal role in the biometric revolution of eKYC, offering unparalleled portability and convenience. These devices empower customers to effortlessly provide their unique biometric data, whether through quick fingerprint scans or taking selfies, anytime and anywhere.

When out in the field, customers can swiftly submit their biometric data utilizing mobile ID devices. These data are then cross-verified with ID databases like Aadhaar to authenticate important documents such as national ID cards. This expedites the eKYC process and promotes inclusivity, particularly for individuals with limited digital presence.

The introduction and adoption of biometric mobile ID demonstrate how technology is continually pushing the boundaries of what's possible in eKYC, making the process more accessible and user-friendly, and driving inclusion by reaching out to broader segments of the population.

{{product-cta}}

The transformative power of eKYC isn't just confined to streamlining the verification process. It also brings along a plethora of benefits for both the service providers and the customers. In this section, let's dive into these advantages, and learn why eKYC is a pivotal player in the digital era.

For Financial Institutions and Other Service Providers

The eKYC process significantly trims down the time needed for customer onboarding. The need for physical presence or paper documents is eliminated, making it a swift and seamless experience.

By replacing traditional KYC's paper-intensive methods with digital verification, organizations can drastically cut down on operational costs associated with document handling and storage.

eKYC reduces the chances of human errors that might occur while entering data or verifying documents. By leveraging automation, it ensures more accurate data collection and validation.

With a digital process, businesses can handle a higher volume of KYC checks in less time. This scalability allows for rapid growth, particularly for online businesses.

eKYC simplifies the compliance with KYC regulations. Digital records are easier to maintain, retrieve, and audit, helping organizations stay on the right side of KYC and Anti-Money Laundering (AML) laws.

For Customers

The process can be completed from the comfort of home, without the need to visit a physical location or submit paper documents. This is particularly advantageous in a post-pandemic world, where remote processes are becoming the norm.

Thanks to the automated nature of eKYC, new customers can be verified and onboarded rapidly, sometimes in real-time. This quick turn-around can greatly enhance customer satisfaction.

By using advanced encryption technologies, eKYC ensures that customer data is securely stored and transmitted.

In an increasingly eco-conscious world, the move to a paperless process is not just convenient, but also environmentally friendly.

eKYC, therefore, is a win-win scenario. It is a powerful tool that not only ensures compliance with legal procedures but also enhances the customer experience. Its benefits extend far beyond just "knowing your customer" – it is redefining the very way businesses and customers interact in the digital age.

The digital transformation ushered in by eKYC is not confined to the financial sector. It is a wave of change that's disrupting a variety of industries, proving its versatility and applicability in an array of contexts. Let's take a brief tour of how eKYC is redefining norms and elevating standards across different industries.

As the front-runner in the adoption of eKYC processes, the financial sector has seen sweeping transformations. The shift to eKYC has not only accelerated customer onboarding but has also brought significant cost efficiencies while ensuring robust compliance with KYC and anti-money laundering regulations.

In healthcare, accurate patient identification is vital, and eKYC has emerged as a key player in enhancing this process. By offering a quick and reliable way to register patients, eKYC is setting new standards in healthcare efficiency.

E-commerce platforms are leveraging eKYC to fortify their customer verification processes. As online transactions continue to surge, eKYC plays a crucial role in maintaining user trust and ensuring secure transactions.

The telecommunications sector, characterized by high subscriber volumes and a constant need for customer identification, is also harnessing the power of eKYC for a smoother and more reliable onboarding experience.

The transformative power of eKYC is evident across various industries. By redefining customer verification and onboarding, it's driving growth, increasing customer satisfaction, and paving the way for a digital future.

As we gaze into the future, it's clear that eKYC is not a fleeting trend. It is a substantial shift in how businesses will identify and verify their customers, powered by advancements in technology and changes in consumer behavior. So, what does the future hold for eKYC?

Emerging technologies like artificial intelligence (AI) and blockchain are set to synergies with eKYC, further enhancing its capabilities and applications.

Harnessing biometric data for eKYC processes is becoming more prevalent. Whether it's facial recognition, fingerprints, or iris scanning, biometric technology is setting new benchmarks in customer verification, providing an unparalleled mix of speed, accuracy, and security.

The adoption of eKYC will likely extend beyond financial institutions and become a standard in various industries, from healthcare and education to travel and hospitality. With the convenience and security offered by eKYC, it's only a matter of time before more sectors embrace this digital transformation.

As the adoption of eKYC grows, regulatory bodies around the world are expected to provide greater support and clearer guidelines. The challenge will be to balance the need for security and privacy with the advantages of fast and efficient customer verification.

With these trends, the future of eKYC looks promising. Not only will it continue to simplify customer onboarding and reduce fraud risk, but it will also enable businesses to comply with regulatory standards more efficiently. Its advancement will undoubtedly push the boundaries of digital transformation, redefine customer experiences, and reinforce the crucial role of digital identity in our world today.

As we've seen, eKYC represents more than just an advancement in technology. It's an entirely new approach to the way businesses interact with customers. By offering a streamlined, efficient, and secure method for customer verification, eKYC is transforming industries and paving the way for a digital future where paperless processes and swift onboarding become the norm rather than the exception.

The financial sector has been a trailblazer in this regard, but we've only scratched the surface. Other sectors are also adopting eKYC, realizing its potential in enhancing customer experience, reducing fraud risk, and ensuring regulatory compliance.

Moreover, the fusion of eKYC with biometrics and other advanced technologies has unlocked new possibilities. It has not only enhanced the security of the verification process but also made it remarkably user-friendly. As our company Aratek continues to innovate in biometric solutions, we are excited to be a part of this evolving landscape.

In a world increasingly becoming digital, eKYC is proving to be an invaluable tool. As we move forward, it is set to redefine the interaction between customers and businesses, making transactions smoother, safer, and more convenient. While the journey has just begun, the future of eKYC is promising, bringing us closer to a seamless, secure, and digital world.

And with that, we draw the curtain on this in-depth look at eKYC. Whether you are a customer wondering about the next steps of online verification or a business considering adopting eKYC processes, we hope this article has shed some light on the importance of eKYC and how it stands to revolutionize the future. Stay tuned for more exciting insights into the world of digital identification and customer verification!

.avif)

Use our product finder to pinpoint the ideal product for your needs.