PRODUCT

Smarter Biometrics, Stronger Digital Identity.

VIEW ALL

product finder

solution

case study

support

Company

Identifying the World. Easily, Securely.

years of solid experience

20+

.jpg)

400+

customised projects

EN

.avif)

%3F%20From%20Basic%20to%20Biometric.jpg)

Have you ever wondered how financial institutions manage to maintain trust and security amidst a maze of transactions and clients? At the heart of this complex system lies a crucial process known as Customer Due Diligence (CDD). This method is integral to Anti-Money Laundering (AML) and "Know Your Customer" (KYC) practices, serving not just to fulfill legal obligations but as an essential strategy for understanding who the customers are and what risks they may pose. Beyond its role in combating financial crimes like money laundering and terrorist financing, CDD plays a significant part in securing customer relationships and enhancing the overall trustworthiness of financial operations.

This article explores the world of CDD, providing a comprehensive guide to its implementation, significance, and the role that biometric technologies and solutions are starting to play in improving these critical security protocols.

Customer Due Diligence (CDD) is a foundational practice within the financial sector, crucial for maintaining the integrity and security of financial transactions. At its core, CDD is a risk management strategy used by financial institutions to ensure they understand who their customers are and ascertain the potential risks associated with maintaining a business relationship with them. This process is crucial for adhering to Know Your Customer (KYC) guidelines and global anti-money laundering (AML) regulations, thereby preventing the institution from inadvertently facilitating financial crimes such as money laundering and terrorist financing.

The primary purpose of conducting thorough CDD is to protect financial institutions against fraud, identity theft, and other illicit activities that could harm their operations and reputation. By carefully verifying the identity of their customers and understanding the nature of their customers' business and financial activities, institutions can develop robust customer risk profiles. These profiles are critical for detecting anomalies and potential risks that could indicate suspicious activities or high risk customers.

CDD forms the backbone of effective risk management and compliance frameworks within financial institutions, helping them detect and prevent suspicious activities that could potentially expose them to financial and reputational damage.

Globally, the practice of CDD is bolstered by guidelines from international bodies like the Financial Action Task Force (FATF), which sets international standards aimed at preventing financial crime. Compliance with these standards is not just about adhering to legal requirements but also about protecting the integrity of the financial system on a global scale. In jurisdictions like the United States, the Bank Secrecy Act (BSA) and the USA PATRIOT Act outline specific CDD mandates, while the European Union's Anti-Money Laundering Directives (AMLD) provide similar regulatory frameworks in Europe.

In today's digital and global economy, the importance of CDD cannot be overstated. With the increasing complexity of financial transactions and the broad range of entities involved—from individual consumers to large corporations and other financial institutions—CDD plays a crucial role in ensuring that the financial system remains transparent and trustworthy. Furthermore, the process of CDD provides a critical foundation for subsequent activities such as ongoing monitoring and risk assessment, which are necessary to ensure ongoing compliance and secure customer relationships.

Through effective CDD, financial institutions not only comply with regulations and avoid severe penalties but also fortify their defenses against financial crime, thereby enhancing the overall security and stability of the financial markets.

Customer Due Diligence is a multifaceted process, involving several critical steps designed to identify the risks associated with new and existing customer relationships. Each component of the CDD process plays a strategic role in building a comprehensive understanding of the customer and ensuring the financial institution's operations remain within the legal and ethical boundaries of regulatory requirements.

Before a financial institution can open an account or maintain an existing relationship, it must know with whom it is dealing. This initial step is crucial for setting the foundation for all future interactions and risk assessments.

Developing an accurate customer's risk profile requires a thorough understanding of the customer’s business and the origins of their wealth, which is essential for ensuring compliance.

After gathering and verifying the necessary information, assessing and categorizing the customer's risk level is a critical next step. This assessment is based on various criteria, including geographical locations, the nature of the business, transaction patterns, and the political exposure of the customer.

Continuous monitoring of the business relationship is essential to detect any deviation from the expected activities that could suggest potential risk issues or the need for further investigation.

Through these detailed processes, financial institutions can not only assure regulatory compliance but also foster a safer financial environment by identifying and mitigating potential risks proactively. This section outlines the essence of conducting thorough customer due diligence solutions and sets a strong foundation for discussing more advanced aspects such as Enhanced Due Diligence and the incorporation of cutting-edge technologies like biometrics into the diligence process.

Understanding the various types of Customer Due Diligence (CDD) is essential for financial institutions as they navigate the complexities of anti-money laundering (AML) regulations and strive to prevent financial crimes. The level of due diligence required can vary significantly depending on the perceived risk associated with a customer. Here, we break down the primary types of CDD used in the financial sector to ensure thorough compliance and effective risk management.

In cases where the risk of money laundering or terrorist financing is low, financial institutions may apply Simplified Due Diligence. This lighter form of due diligence is typically permissible under certain conditions:

Simplified Due Diligence is not just a reduction in effort but a calculated decision based on clear criteria that suggest a minimal risk.

Basic Customer Due Diligence, also known as Standard CDD, is the minimum requirement for all new customer relationships. This customer due diligence process includes:

This level of due diligence is sufficient for customers categorized as lower risk, where there is little likelihood of money laundering or terrorist financing.

Enhanced Due Diligence (EDD) is necessary for customers deemed to pose a higher risk, such as those from high-risk countries, those holding public positions, or companies with complex ownership structures. EDD involves more rigorous procedures to mitigate the elevated risks:

Politically Exposed Persons (PEPs) require a distinct category of due diligence due to their position and the potential risks of corruption and bribery associated with their status. This process often mirrors EDD but with a specific focus on the political, social, and economic context of the individual:

By employing these varying levels of Customer Due Diligence, financial institutions can tailor their risk management practices to match the risk profile of each customer, ensuring that they effectively combat financial crimes while maintaining compliance with regulatory demands. This approach allows institutions not only to protect themselves but also to foster trusted and secure customer relationships.

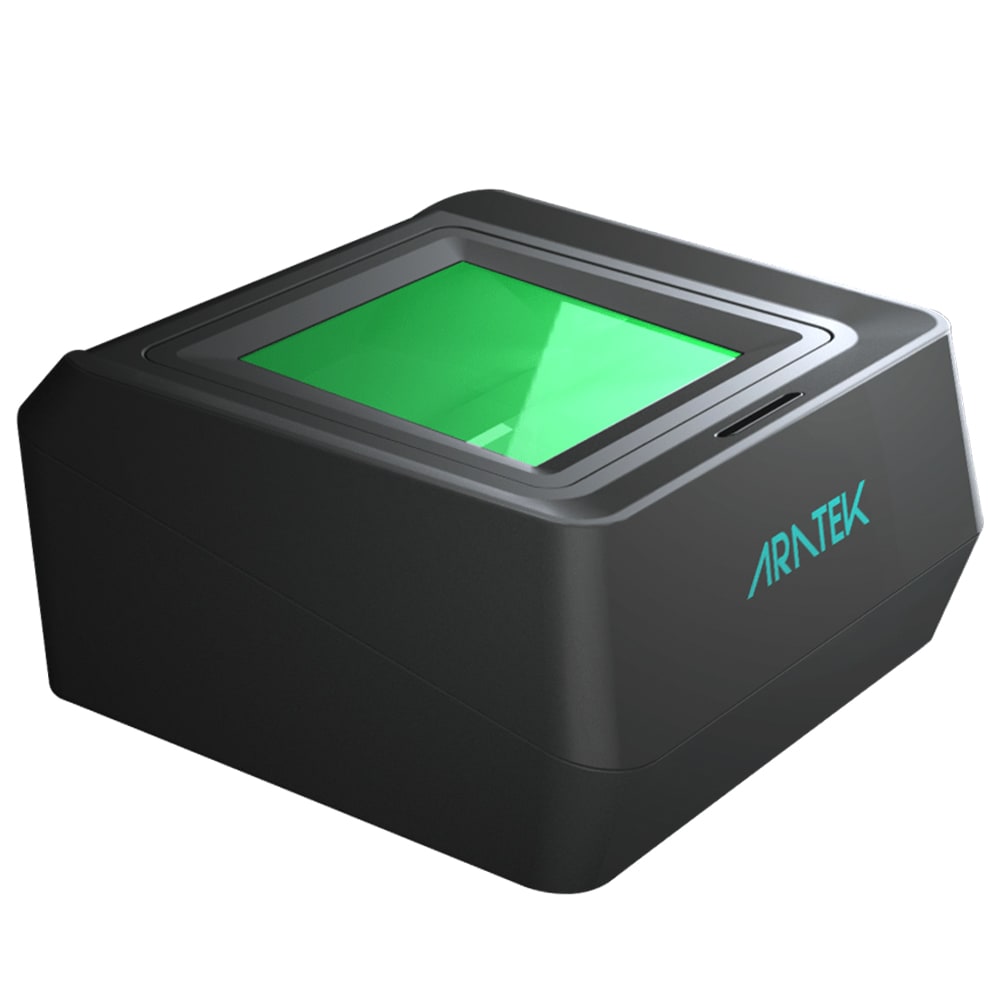

Biometric verification is increasingly recognized as an essential method in the field of Customer Due Diligence (CDD). By incorporating biometric data into various stages of the CDD process, financial institutions can significantly enhance the accuracy and reliability of identity verification, streamline compliance procedures, and improve overall security.

Biometric verification can be seamlessly incorporated into several stages of the CDD process:

At the outset of a customer relationship, biometric data such as fingerprints, facial recognition, or iris scans are collected and matched against official documents or digital databases. This ensures that the identity information provided by the customer is accurate and greatly reduces the possibility of fraud.

Biometric data can also be linked to document verification processes. For instance, facial recognition technology can be used to compare a live image of the customer to the photo on their ID document, ensuring that the document belongs to the person presenting it.

For high-risk customers, biometrics can be crucial. Enhanced scrutiny can involve biometrically verifying a customer's identity in multiple contexts or over time to track any changes or discrepancies that might indicate potential risk. This could include more frequent or detailed biometric checks to ensure ongoing reliability of their risk profile.

Adopting biometric verification in CDD processes offers a range of benefits that enhance both compliance and customer experience:

By verifying customers' identities using biometric data, financial institutions can significantly enhance the security of their operations. This is particularly vital in preventing identity theft and financial fraud.

With stringent anti-money laundering (AML) and counter-terrorism financing (CTF) regulations in place, biometrics help institutions meet these compliance requirements more effectively by providing irrefutable evidence of identity verification.

Biometrics can lead to a smoother and more efficient customer experience. Quick and easy verification processes reduce wait times and the need for physical documentation, leading to higher customer satisfaction.

While the initial setup costs for biometric systems can be significant, the long-term benefits include reduced labor costs and fewer losses from fraud, which can translate into substantial cost savings for financial institutions.

By integrating biometric verification into their CDD processes, financial institutions can not only enhance the accuracy and efficiency of their operations but also provide a safer, more streamlined customer experience. This integration marks a significant advancement in the ongoing evolution of customer due diligence practices.

Artificial Intelligence (AI) and Machine Learning (ML) are transforming the landscape of Customer Due Diligence (CDD), offering financial institutions unprecedented capabilities to automate processes, enhance accuracy, and deepen insights into customer behaviors and risk profiles. These technologies are pivotal in streamlining compliance, improving monitoring, and ensuring efficient management of regulatory demands.

AI and ML can significantly streamline several aspects of the CDD process, making them indispensable tools for financial institutions:

The application of AI extends beyond mere data analysis to encompass broader compliance and monitoring functions:

Looking forward, the role of AI and ML in Customer Due Diligence is set to expand, offering even more sophisticated tools for risk management. Financial institutions that embrace these technologies can not only improve their operational efficiencies but also gain a competitive edge in risk management and customer service.

As we have explored, Customer Due Diligence (CDD) is a crucial framework within financial institutions, designed to mitigate risks associated with financial crimes such as money laundering and terrorist financing. From the basic steps of identifying and verifying customer identities to the sophisticated use of biometric verification and AI-driven technologies, CDD practices are continually evolving to meet the challenges of an increasingly complex global financial landscape.

A well-structured customer due diligence checklist is an invaluable tool for ensuring that all necessary steps are covered and that no critical aspects are overlooked. This checklist serves as a roadmap for compliance officers and financial institutions to systematically verify customer information, assess risks, and perform necessary background checks. Incorporating elements like identity verification, risk assessment, ongoing monitoring, and the integration of new technologies into the checklist can help institutions maintain a robust CDD framework.

In conclusion, the essence of effective Customer Due Diligence lies in its ability to adapt and integrate new methodologies and technologies. By staying informed and prepared, financial institutions can ensure that their CDD processes not only comply with current regulations but also provide a solid foundation for secure and trustworthy customer relationships.

.avif)

Use our product finder to pinpoint the ideal product for your needs.